The Debt Limit: Not a Credible Way to Control Spending

More on:

The Bipartisan Policy Center today has produced a package of charts on the debt limit. Their bottom line isn’t shocking, but it’s persuasively laid out:

- The debt limit is expected to become binding (i.e., extraordinary measures will become exhausted) between February 15 and March 1. The limit needs to be raised by $1.1 trillion to get through 2013 and by $2.1 trillion by the end of 2014.

- There is no secret bag of tricks: the Administration’s view is that the 14th Amendment does not give it the power to ignore the debt ceiling; other ideas, such as minting a trillion-dollar platinum coin, are seen as impractical, illegal and/or inappropriate.

- This leaves the Treasury little choice but to begin to run arrears after the debt limit becomes binding. On average, the Treasury takes in only $0.60 for each dollar of spending, so arrears would be broad-based and accumulate rapidly.

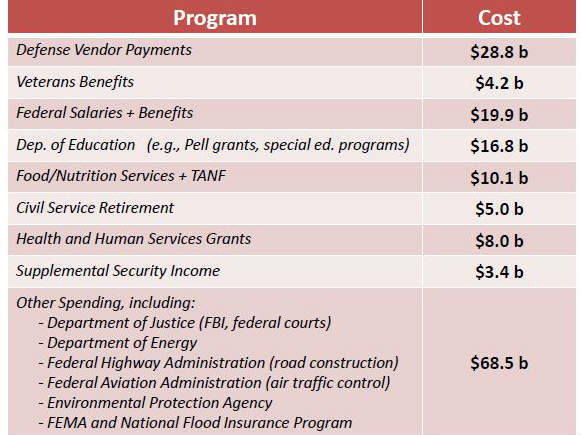

- Treasury could prioritize payments, but that presents substantial political as well as practical (i.e., reprogramming computers) challenges. Why is government paying the debt but not paying for federal salaries, veterans benefits, and food safety? (See their tables for prioritized payments from February 15 to March 15, below.)

- The alternative is to pay bills as they become due. But this would mean a quick default on U.S. government debt, possibly at the end of February when a $6.6 billion interest payment is due. (Treasury also would have to roll over roughly $500 billion in debt from February 15 to March 15, a task that could be extremely difficult to manage given the risk of default.)

My takeaway is that any partial payment strategy–even one that paid debt in full–would quickly become hugely disruptive for the US economy, and is not sustainable on political as well as economic grounds. For that reason, it’s hard to see how going over the debt limit is a credible, useful way of disciplining spending. I expect that market participants will broadly come to the same conclusion, and that expectations of a deal will limit “market discipline” as we approach the cliff (as was the case in 2011). Further, if revenue is boosted by end-year, tax-driven transactions, it’s possible Treasury can go into March before it exhausts the extraordinary measures. But a troubled auction or continued gridlock could change market expectations in a hurry.

BPC Table. Illustrative Scenario #1: Protect Selected Big Ticket Programs

If you choose to pay these programs for a total of $276.5 billion...

...then you can’t fund these programs, worth $175 billion.

Source: Bipartisan Policy Center

More on:

Online Store

Online Store